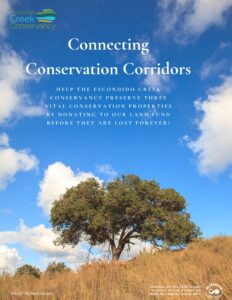

People and wildlife need the same things —places to find food, safe shelter, community to find a mate, and a peaceful life to raise their young. Habitat fragmentation due to development is one of the greatest threats to wildlife survival. This extensive loss of wildlife corridors threatens the survival of many species and increases wildlife conflicts with people and pets.

That’s where you come in. With your donation to our Land Fund, the Conservancy can connect habitat corridors in North County by saving three key properties. The White Atterbury (San Elijo Hills), Elfin Acres (Elfin Forest) and Kesting Dairy (Harmony Grove) properties are for saleand with your help we can purchase them and save them. These properties serve as critical wildlife corridor connections.

Donate now to our Land Fund to help the Conservancy work towards protecting these properties before they are lost forever.

Thank you for supporting the Conservancy’s Land Fund!

All Hands In Campaign

The Escondido Creek Conservancy Is All Hands In

Supporting the people that make conservation happen.

With the support of our wonderful donors like you, The Escondido Creek Conservancy has had great success leveraging small private donations into millions of dollars in grants that have resulted in the protection of thousands of acres of conservation land in North San Diego County.

When you donate to the operations of the Conservancy, to the All Hands In campaign, your gift directly supports:

- Land acquisition, so the mission of the Conservancy is realized.

- Compliance with Land Trust Alliance standards and practices, so the Conservancy meets or exceeds national standards and that our lands are fully protected in perpetuity.

- Strategic leadership, so the Conservancy is an effective conservation leader.

- Effective communications and outreach, so Conservancy supporters and the public learn about the Conservancy’s work and are called to action.

Contribute to All Hands In by buying a brick.

Support the Conservancy’s work by purchasing a customized brick for our new office space in Hidden Meadows. Your brick can be engraved to honor a loved one, showcase your support for conservation, or create a lasting legacy of your family name! Two options are available: 4×8 bricks at $100 or 8×8 bricks at $250.

Learn more about the All Hands In campaign by clicking here.

Discover other ways to give here (link: current donate page with its new URL)

Contact our Executive Director Ann Van Leer at (760) 471-9354 or by email at [email protected] with any questions.

The Conservancy is a 501©(3) nonprofit organization.

Tax ID: 33-0497525.